What Is Mainvest?

Launched in 2018, Mainvest is an investment marketplace for brick-and-mortar stores and businesses – also known as Main Street businesses. Mainvest offers investors an easy way to invest in small businesses and local shops and provides business owners with a direct avenue of communication with potential investors.

Mainvest was founded by Nicholas Mathews, and the main goal was to make investing in small businesses accessible for the average investor. Mainvest is available for accredited and non-accredited investors – both in the US and outside –and the only requirement is that you have a US bank account. It has a very low minimum investment compared to other investing platforms, and you can get started with just $100.

In this quick Mainvest summary, I will go over some of the best features of this platform so you can decide for yourself if this is the right platform for you. For a more in-depth analysis, check out our full Mainvest review.

Pros & Cons of Mainvest

Pros

- Available for accredited and non-accredited investors

- Specialized focus on small businesses

- Very high returns (10%-25%)

- Low minimum investments (around $100)

- More than 450 investing opportunities

- Highly vetted investments

- Access detailed business information from the Mainvest Dashboard

- Educational resources

- No investor fees

Cons

- Investing in start-ups or small businesses can be risky

- Illiquid investments

- 5%-9% fees (only for businesses looking to get listed)

Access Diversified Investments

With Mainvest, you can invest in a highly diversified portfolio of small businesses like local breweries, restaurants, bakeries, and coffee shops. Keep in mind that you don’t need to be an accredited investor to invest in Mainvest.

The four main categories of local investments are:

- Breweries

- Restaurants

- Bakeries

- Specialty

There are more than 450 investments available on the Mainvest marketplace, and target returns range from 10% to 25%. Businesses can set their minimum investments, but most start at $100. Here’s a quick guide on making a profit with Mainvest.

Access Detailed Business Information From The Mainvest Dashboard

From the Mainvest dashboard, you can check all the information about any business listed – even before creating an account. On the Investment Opportunity tab, you will find extensive details about the location, including the size of the store, services offered and the number of customers, and a breakdown of their revenue and how they spend it.

On the Data Room tab, you will find graphs, charts, and a comprehensive financial forecast, which considers parameters like gross sales and profits, money spent on rent, utilities, salaries, and repairs, and operating profits for the next five years. You can also check the risk factors for that particular business.

The Updates tab tracks any new development and is one of the ways business owners can share information directly with investors. You can also discuss with other investors and post messages on the Discussion tab.

If you’re an accredited investor looking to get started in real estate, we recommend AcreTrader.

How Does Mainvest Vet Businesses?

Mainvest doesn’t list all businesses that apply, and they require all businesses to raise at least $10,000 from people they personally know. Only 5% of all businesses that apply are accepted. Here are some other steps they take to make sure the listed companies are trustworthy:

- Anti-Fraud Vetting: Mainvest minimizes the risk to investors by researching the business owners extensively to make sure they’re capable of managing investors’ funds under Regulation Crowdfunding

- Responsibility Check: For this, Mainvest considers the lack of communication, social media activity, and financial history of the business owners

- Bad Actor Check: Mainvest also conducts a background Bad Actor Check (BAC), which includes owners, managers, and officers, plus any beneficial owner of 20% of the business or more

Even after the business is approved and its offering listed, Mainvest monitors any additional information that may become available. One of the main disadvantages of Mainvest is that it doesn’t offer real estate investments – if you are interested in that industry, we recommend First National Realty Partners.

Educational Resources

Mainvest offers new investors educational resources, accessible on the Mainvest website. It’s a complete walkthrough of what all investors should consider before getting started and includes topics like:

- What you should consider first

- Do’s and don’t do’s

- How we screen issuers

- Types of securities offered

- Limits on how much you may invest

- Risks of investing

Educational resources are available for free – you don’t even need to register to access this information.

Mainvest Fees

- For Investors: Free

- For Businesses: 4.5%-9% of the amount you raise

Mainvest doesn’t charge any fee to investors that choose to invest in any of the businesses listed. For businesses, however, there is a fee ranging from 4.5% to 9%, depending on how the investor found your listing (through your link or through the Mainvest ecosystem of investors).

For businesses, Mainvest doesn’t charge an upfront fee; instead, it charges the percentage when the campaign ends.

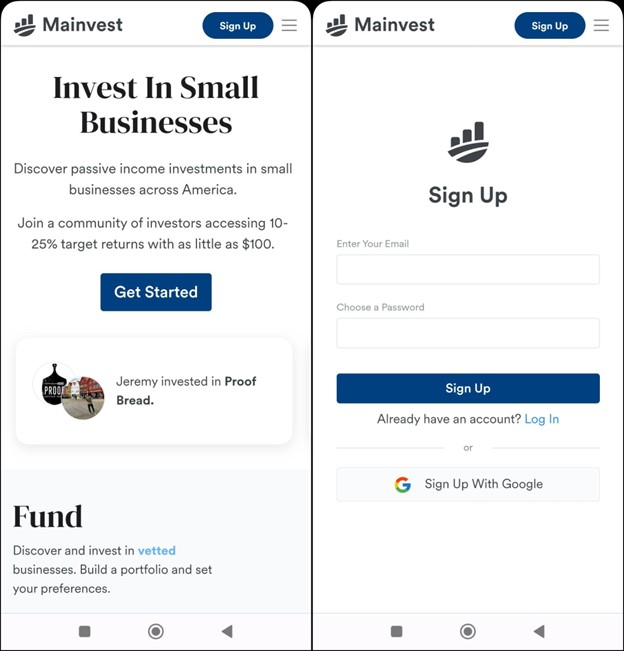

Sign-Up Process

Signing up for Mainvest is completely free for investors, but you will need a US-based checking account to start investing. This is because Mainvest operates as a Regulation Crowdfunding portal, meaning only US-based businesses can register and get listed. Here are the steps to sign up:

- Click Sign Up on the top right

- Enter a valid email address and create a password

- Confirm some of your basic information

- Link a bank account through Plaid

Make sure to use our link to sign up, and you’ll get a $20 welcome bonus credited directly to your Mainvest account after you link your bank account through Plaid.

Mainvest is always looking to increase its reach. As of 2022, they’re actively looking to offer overseas investors the option to participate through SDIRA and credit card investments – without a US bank account.

Final Thoughts

Mainvest is an excellent platform for non-accredited and everyday investors who want to invest in an asset class that has historically been reserved for the wealthy; small businesses. Mainvest offers very low minimum investments and a highly diversified portfolio of options to choose from. They have a very stringent vetting process, which makes this platform one of the safest out there. For businesses, it can be very profitable to use this platform if you want to connect with the Mainvest investor ecosystem and reach your funding goals. For those reasons, we recommend this platform for individuals and businesses alike.